After much anticipation of the 2013 experience rating split point change, here we are in January with 2013 expected loss rates published for over 20 states. This means we can get beyond estimates and see exactly how mods are reacting to the split point change.

Some of you have undoubtedly seen the effects firsthand in mods effective 1/1/2013. The question I’m hearing over and over is “How much of the mod change is due to the rates and new split point?” In other words, “What if the payroll and losses hadn’t changed?”

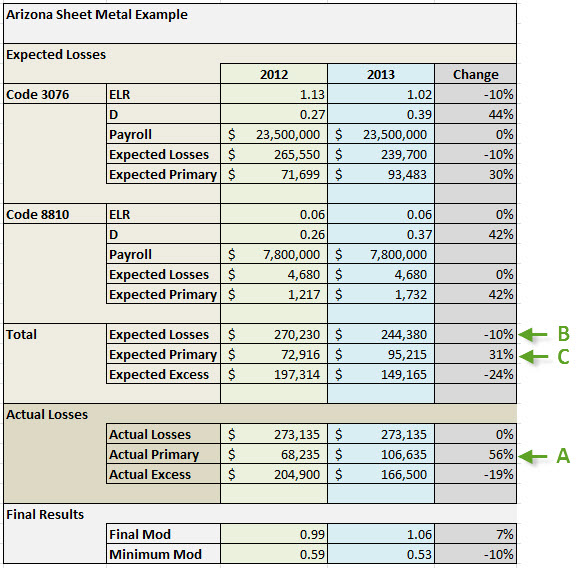

It’s an interesting exercise, even if it’s unlikely to occur in real life. And it’s a somewhat complex exercise, because there are so many “moving parts” to the rating formula. But in this article I’m going to attempt to illustrate some of the more interesting variables that may affect mods this year. To do so, I’ve created a hypothetical sheet metal fabrication company doing business in Arizona. While the employer’s payroll and loss experience are a product of my imagination, the rates for 2012 and 2013 are entirely real.

Three reasons a mod can change

As always – not just in 2013 – a mod may change from one year to the next due to

- Differences in the employer’s loss experience

- Differences in the employer’s size, as measured by payroll

- Differences in rates – the ELRs (expected loss rates), D-ratios, weighting and ballast values used in the formula

Our sample risk – how does it change and why?

In the following scenario I have taken the exact same payroll and losses and used ModMaster to calculate the mod using both 2012 rates and 2013 rates. Here are the highlights of those calculations:

(Note that I am not showing all aspects of the calculation in order to focus on the most interesting points for this discussion. The below estimates of mod increases and decreases are determined using ModMaster and some spreadsheet analytics. )

As you see above, for the exact same payroll and losses, the mod for this hypothetical company increased from 0.99 in 2012 to 1.06 in 2013. Here are the most notable contributing factors:

The increase in actual primary losses due to the new split point

(Item A in the graphic above)

- Even though total actual losses stay the same, the increased split point causes a shift of losses from excess to primary. Actual primary losses increase from 68,235 to 106,635, and excess losses decrease correspondingly.

- This change alone, applied to the 2012 mod, would cause an increase of 11 points. The mod doesn’t increase quite that much in 2013 because of the effects of D-ratio changes, discussed below.

The decrease in total expected losses

(Item B in the graphic above)

- For this risk, the ELR for payroll code 3076 happened to decrease from 1.13 to 1.02, driving a 10% decrease in expected losses.

- Whether an ELR increases or decreases from year to year depends on loss experience in the given state, so this is unrelated to the split point change

- This change alone, applied to the 2012 mod, would cause an increase of 4 points.

The fact that expected primary losses did not increase as much as actual primary

(Item C as compared to Item A in the graphic above)

- In 2013 a special concern regarding the rates is something NCCI refers to as “Differences in class severity” (see the NCCI webinar Understanding the Filed Experience Rating Plan Changes-Item E-1402—Webinar on Demand).

- These differences in class severity refer to the fact that D-ratios, which are used to calculate expected primary losses (and, by extension, expected excess losses), are being increased considerably in 2013. Since actual primary losses are going up due to the split point increase, it makes sense that expected primary losses should increase correspondingly.

- The value of a specific classification’s D-ratio and the amount of its increase from 2012 to 2013 varies from payroll code to payroll code. While increases average about 50% across all classes, increases for specific classifications typically range from 20% to 80%. So if a class code’s D-ratio has a lower than average change, this may be a contributing factor in a mod increase, although actual loss experience is by far the most important factor.

- The change in D-ratios alone, applied to this 2012 mod, results in a decrease of 7 points, illustrating the power of the D-ratio to affect the mod and how D-ratio increases in 2013 will work to offset the split point increase.

How will the experience rating split point change impact your – or your client’s – mod?

It’s important to remember that about 75% of risks will experience a mod decrease due to the split point change. But for some of the 25% who experience an increase, that increase may be painful. With all of the moving parts – loss experience, payroll, and the rates and split point – it can be a job to understand exactly why the mod changed. (Shameless self-promotion alert – ModMaster helps!) But this year’s change underscores what we’ve always known: Although some factors affecting the mod are beyond the employer’s control, loss control should be priority one.

As always, I’m glad to hear about your own experiences and concerns regarding this subject!

– Kory Wells, WorkCompEdge Blog Editor

© 2013 Zywave, Inc. All rights reserved. For reprint permission, contact the blog editor.

For further information:

On NCCI.com:

Understanding the Filed Experience Rating Plan Changes-Item E-1402—Webinar on Demand

Additional NCCI resources on the split point change

On the WorkCompEdge blog:

Thank you for the interesting articles. I would like to know if report only claims to the workmen’s comp insurance carrier are used to calculate the modifier. Watching the NCCI videos, they list a primary loss as under $10,000. Does a $O report only loss count as a primary loss? Often times as an employer you want to err on the safe side and report everything!

Hi, Virginia,

Thanks for reading! A $0, report-only loss should not affect the mod at all – in fact, one doesn’t usually see $0 losses even listed on the bureau worksheet. So to specifically answer your question, a report-only loss would not affect the primary or excess loss components of the formula.

Reporting everything can be a good idea, as you never know when a very minor injury may turn into something bigger. However, your broker or agent should be able to give you more specific guidance on this issue.

All best,

Kory

This is the best comprehensive list of information in regards to the mods. Thanks for spending however much time you took to create this.

Thanks for reading, Todd!

Kory