In the universe of workers’ compensation experience rating, 2013 has been something of a big bang: The split point increase to $10,000 in most states has realigned mod values which had, over the years, begun drifting closer and closer to 1.0. If you’ll indulge the imperfect analogy, think of planets (mods) getting closer and closer to the sun (the mod unity value of 1.0) until everything is too close together and the galaxy starts spinning just a bit off balance. The ongoing split point change is meant to spread the range of mods and rebalance the galaxy.

As most of you know by now, the 2013 split point increase caused some mods, whether debit or credit, to change significantly. Therefore many agents, brokers and employers are now asking:

“As the experience rating split point continues to change in 2014 and beyond,

will the change in mods continue to be so dramatic?”

Depending on when your state updates expected loss rates, you may have only recently started seeing mods with the new $10,000 split point. But some states are ready for the next round. Rates effective 1/1/2014 have recently been published for a couple of NCCI states, so in this article we’ll take a look at some sample scenarios using those rates, for those of you who are interested. But first let’s discuss:

The generalities of the $13,500 split point: Fewer dramatic mod changes

As you may recall, after being at a stagnant $5,000 for more than 20 years, the split point in most independent and NCCI states * is on a schedule to be increased to

- $10,000 in 2013

- $13,500 in 2014

- $15,000 plus claim inflation – for an estimated total of $17,000 or $17,500 – in 2015, plus

- Future adjustments for claim inflation in 2016 and beyond

For 2013, the general rule of thumb was that the new split point would cause credit mods to decrease and debit mods to increase, with a little less predictability on which way mods close to 1.00 would flex. Individual mods could vary widely from this pattern, depending on the exact mix of all the moving parts in the calculation, as I shared in this example. Many of you also had the painful experience, thankfully in a minority of cases, of explaining why a risk’s already-bad mod became much worse.

For 2014 these trends will continue, but with an important distinction: Neither the change in rating values – specifically D-ratios – nor the change in mods will be so dramatic, NCCI has confirmed. In light of this information, I’m encouraging agents and brokers to start thinking of the split point change not as an event to plan for, but as just another annual change, along with expected loss rates, D-ratios, weighting and ballast factors, and more. (Shameless self-promotion alert: When you need to understand exactly why the mod changed, the mod comparison in reports in ModMaster are very helpful!)

Sample 2014 Mod Changes

With that said, I know that the mod nerds among us appreciate the insight of specific examples. So let’s consider a summary of the Maryland rating values effective 1/1/2014:

- Expected loss rates, used to calculate total expected losses, changed an average of about 2%; changes for specific payroll codes ranged from -29% to +33%.

- D-ratios, used to calculate expected primary losses, changed an average of about 22%; changes for specific payroll codes ranged from 14% to 33%.

- The split point for actual losses increased from $10,000 to $13,500.

- Other factors, including ballast and weighting values, also changed but were not significant in the particular scenarios below.

While specifics will certainly vary state to state, this overall profile should be similar for most states’ 2014 rating values.

Now let’s look at some simple mods that I’ve invented for the express purpose of highlighting specific ways in which the factors and split point can contribute to mod changes. The faux employers’ payroll and loss experience are constant over both years, a scenario unlikely in the real world. The rating values shown for 2013 and 2014, and the resulting mods, are accurate.

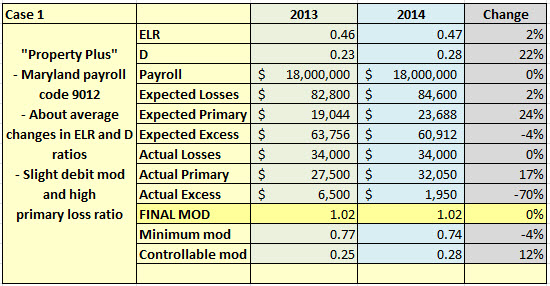

Case 1: A Mod Near 1.00 Stays the Same

For this case, we have a property management company with a slight debit mod and relatively high primary losses in 2013. Fortunately for them, their ELR and D ratios changed about the average amount in 2014 – enough to enable their mod to stay the same.

What particular opportunities does this risk have? Since their actual primary losses are high compared to expected primary, they probably have a loss frequency issue. Note also that their minimum mod has dropped a few points, giving them an even lower goal for their loss-free, or best possible, mod.

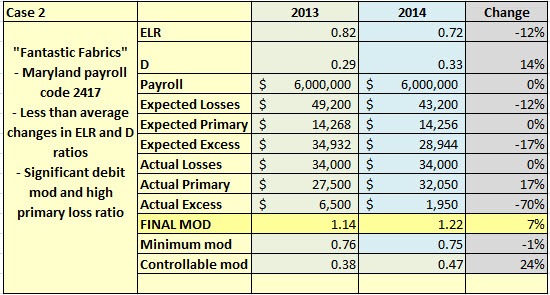

Case 2: A Debit Mod Increases

For this case, I specifically picked a payroll code that had considerably less than average changes in its ELR and D values. This caused both total expected losses and expected primary losses to drop from 2013 to 2014, even though payroll stayed the exact same. Those changes worked against the employer, who had a fairly significant debit mod in the first place, to increase that debit mod by another 7%.

What particular opportunities does this risk have? While it would be prudent (as always) to make sure their payroll is in the correct class, there’s nothing to be done about the change in rating values. What’s much better to focus on here is loss experience, and particularly primary losses being high, pointing to a loss frequency issue.

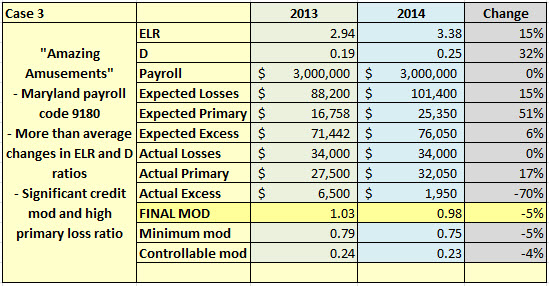

Case 3: A Slight Debit Mod Decreases into Credit Territory

For this case, I selected a payroll code that had markedly greater than average changes in its ELR and D ratios. This led total expected losses to increase 15% and expected primary to rocket up over 50%, in turn enabling this mod to shift from a slight debit to a slight credit.

What particular opportunities does this risk have? I would encourage this employer to not become complacent because their mod is less than 1.0. As with the other sample mods, this risk still has primary loss issue and has significant room for improvement possible, as their minimum mod, also down in 2014, shows.

Summary

As these samples show, under the right conditions a change in rating factors alone can lead to an increase or decrease in the mod, and the 2014 split point is only one of the factors that may be the culprit. Even so, are any of these factors alone the driving force behind the majority of mod changes? No. While everyone should understand that occasional outliers may occur, it’s much better to focus on loss experience as the most important factor in understanding and controlling mods – especially as experience rating’s “big bang” of 2013 becomes history.

– Kory Wells, WorkCompEdge Blog Editor

© 2013 Zywave, Inc. All rights reserved. For reprint permission, contact the blog editor.

For further information:

On NCCI.com:

Understanding the Filed Experience Rating Plan Changes-Item E-1402—Webinar on Demand

Additional NCCI resources on the split point change

On the WorkCompEdge blog:

Experience Rating Split Point Change FAQs

* All states that utilize NCCI, with the exception of Massachusetts, have approved the split point change. Missouri is phasing in the split point over 4 years instead of 3. The independent states of Michigan, Minnesota, New York and Wisconsin have approved the change; Texas has not.