Many agents, brokers and employers are aware of the experience rating adjustment (ERA) rule that applies to medical-only losses in most states, but we still get a lot of questions about the rule, particularly regarding where it applies. Three more states – Alaska, Georgia, and Louisiana – have recently approved ERA implementation for various effective dates in 2013, so it’s a good time to revisit this important method for reducing workers’ comp mods.

What is the rule?

The experience rating adjustment calls for each medical-only loss in the experience period to be reduced by 70% for the purpose of the mod calculation. Medical-only losses, which are indicated as IJ code type 6, are losses which have no indemnity value (reflecting lost wages). Even if a claim has a very small amount of indemnity as compared to medical, the full amount of the loss will count against the mod. This makes it very important to know each state’s wage waiting period (usually 3-7 days) and to manage return-to-work and lost-time claims with that in mind.

The ERA has considerably increased awareness of the importance of keeping claims medical-only through:

- optimal injury management, especially in the first 24 hours after an injury

- early return-to-work/modified duty

- and good communications between everyone involved in an injury: the injured employee, the supervisor, HR, and medical and insurance staff.

(Shameless self-promotion alert: if you’re a ModMaster user, don’t forget that there’s some great content on these topics in Broker Briefcase, which you can access through the “Next Steps” area of any calculated mod.)

What’s the reason for the ERA?

The experience rating adjustment was first implemented in the late 90s as a way to encourage employers to report ALL losses, not just those involving lost-time claims. Before ERA, companies often paid their small claims to avoid having these claims count against the mod. NCCI and other stakeholders were interested in collecting all possible data for statistical actuarial purposes, so the ERA was introduced.

So, in the vast majority of states, employers should be happily reporting all claims, right? Unfortunately, I’ve heard recently from more than one agent that some carriers are now using predictive modeling that penalizes employers – in the form of reduced or eliminated premium credits – for their small med-only claims. This is causing even those employers with significant credit mods to look for ways to avoid reporting. Paying small claims out of pocket is definitely an advanced topic since it involve state rules, deductible plans, possible penalties, and more, but it’s one that all of us in this business may want to learn more about in the coming months.

Where is the rule in effect?

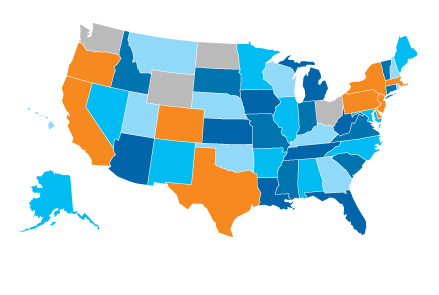

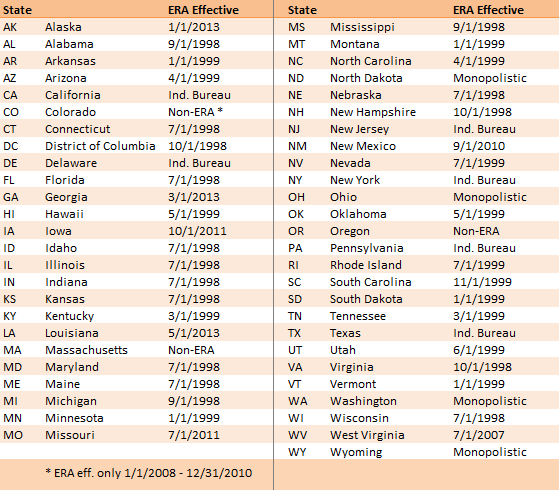

As you can see from the map and table below, which reflect the 2013 changes, the ERA applies in the vast majority of states. In fact, for those states under NCCI jurisdiction, only Colorado, Massachusetts and Oregon will not be ERA states after Alaska (1/1/2013), Georgia (3/1/2013), and Louisiana (5/1/2013) adopt the rule next year.

For further information on the ERA implementation in Alaska, Georgia, and Louisiana, refer to NCCI Item 01-AK-2012 (Alaska), Item 01-GA-2012 (Georgia), and Item 01-LA-2012 (Louisiana).

How is the ERA implemented in ModMaster?

In ModMaster, you should enter the original value of the loss and be sure to indicate it as an IJ code 6 loss. When you do that, ModMaster automatically reduces the loss by 70% if the ERA applies in the indicated state of the loss for the effective date of the mod.

The 2013 ERA effective dates for Alaska, Georgia, and Louisiana will be in ModMaster no later than next week (8/27/2012), so you’ll be able to project a 2013 mod and see how any type 6 losses in those states impact the mod under the new rules. (Understand, of course, you’ll still be using the old rates and split point until they’re published.)

Conclusion

As always, let me know your questions or experiences regarding type 6 losses and the medical-only reduction. Despite some growing concerns about how these losses may be used in underwriting, keeping losses medical-only is a proven way to reduce mods and can reflect that an employer has good injury management and return to work practices.

– Kory Wells, WorkCompEdge Blog Editor

© 2012 Zywave, Inc. All rights reserved. For reprint permission, contact the blog editor.

I getting questions about ERA in GA and the application of small deductibles (GA currently a Net Loss State). I assume it will be a Gross Loss State once the ERA becomes effective on 3/1/13. True? From your experience, does the Expected Loss Rate decrease when ERA becomes effective? If so, won’t the combined effect of a lower ELR and using all of those small claims (both med and indemnity) that were formerly netted out, make the modifications increase quite a bit?

Hi, Mike,

The NCCI circular that describes the change to ERA in GA does not address deductibles at all. It does say that there should be “no significant impact on aggregate premium” because actual and expected losses will both be adjusted. Yes, you’re correct, in general, ELR and D-ratios drop a bit when ERA is implemented, but it shouldn’t be so much that the “average” mod doesn’t stay the same. But with D-ratios being increased for the split point at the same time, plus “normal” adjustments to the rates taking effect as well – whew! there’s a lot of change going on – and certainly some employers may be impacted – positively or negatively – more than others.

You are not the only person wanting more specifics about Georgia. I am sending out a few emails to inquire further, but if you or others know or learn more, please feel free to comment further.

Thanks for reading!

Kory

Thanks for putting on the webinar today. From an insured’s perspective, we are getting slammed with expenses from all sides – and now they change the way the game is played.

So we get punished for frequency, we get punished more for larger claims, we have almost no recourse when an ee files for an injury that happened away from work and end up paying for additional medical expenses in the event the doctor screws up. And now we will get slammed for the poor safety practices of others and medical cost inflation over which we have no control

It is the same old insurance game – you gotta have it – but expect to pay more if you ever need to use it.

Hi, John,

As an insurance consumer, I surely empathize – I had a MINOR fender bender a few weeks ago, but I was at fault, and the first thing that went through my mind was, “There goes my good driver discount!”

Just to be clear, frequency generally affects the mod more than a few severe claims would. I encourage you to work with a broker who can tell you what your minimum mod, or loss-free rating, is, and who gives you some guidance on whether you have a frequency issue, severity issue, or both – and specific resources to address problem areas. Yes, there are numerous factors that are beyond your control…but being educated and taking action on the factors you can control is a positive step that can help control your direct costs AND influence productivity.

Thanks for tuning in – and reading!

All best,

Kory

Update: As of today (12/12/12), 2013 rates for Alaska, Georgia and Louisiana – the three states implementing ERA in 2013 – have all been published by NCCI and are also included in ModMaster.