Last year, Don Bailey and I introduced our e-book – The Sales Revolution – Digital Disruption Demystified: The Ultimate Guide for Driving Brokerage Growth. The Sales Revolution created a strategic guide for brokerage leaders as the insurance market is experiencing seismic market changes thanks to the growing digital landscape. So much is happening that we’ve added an update.

The newest chapter walks you through the process of implementing insurtech into your brokerage, along with tips and tricks for success. It’s all about sequence: the optimal order in which insurance brokerages should implement technology solutions for maximum results. Putting it all together with a strategy, implementation plan and forward-thinking mindset will allow you to embrace market change and leverage technology to its fullest potential and come out on top. Time to get started.

Sequence is Key

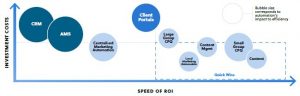

There are six key business solutions that are essential to the modern insurance brokerage that can be broken down into three categories:

- Foundational data systems including your agency management system (AMS) and customer relationship management (CRM)

- Automation force multipliers including your CPQ, marketing automation, and content and content management software

- Client value-adds including a client portal, online enrollment system, HR applications and learning management systems (LMS)

Understanding the sequence, is essential to ensuring that you get the most out of your insurtech solutions.

When you see the chart below, you may think that it’s best to go for the quick wins – the solutions with lower investment costs and a quicker return on investment. But if you don’t lay the right groundwork with a CRM and AMS, you won’t set yourself up for long-term success.

Building Out Your CRM and AMS

AMS and CRM are foundational data systems, and will be the pillar of any brokerage’s success. In combination, an AMS and CRM will make sure you are running a well-oiled system of record and customer tracking mechanisms.

When you are working to select the right solutions for you, it is imperative that you choose two applications that are capable of integrating together when it comes to both data and workflows. There’s an ever-increasing amount of data that is passed between an AMS and CRM, so it is essential to select platforms that have open APIs and integration capabilities.

But it is also important to understand that implementing AMS and CRM systems is an immense amount of work, and will take a lot of time. Depending on the size of the brokerage, implementation can take anywhere from 6 months to 2 or more years. AMS and CRM are the biggest projects when it comes to implementing insurtech solutions, but they are also the cornerstone to a brokerage’s success.

Adding the Quick Wins

As mentioned, implementing your AMS and CRM is a big task. But once you have that process rolling, you can start adding in the quick wins, or your automation force multipliers. Every brokerage is unique and can use these tools differently, but overall a good game plan is to tackle the quick wins in this order:

- Small group CPQ

- Content and content management

- Localised email marketing automation

- Large group CPQ and centralised email marketing automation

You will notice that it’s recommended that you tackle small group customer segments before large group. By focusing on small group customers first you can work to optimise your process before leveraging that experience when you begin automating your large group process.

As you are considering adding in your automation force multipliers, remember that these don’t all need to be implemented before you’ve completed the CRM and AMS implementation. You can tackle these solutions as your time and resources allow. But you should have all of these solutions implemented before moving onto the last stage – adding your external client value-adds.

The Last Step: Client Value-Adds

Once you have built your foundation with an AMS and CRM, and added in your automation force multipliers, the last key component is your external, client value-adds. These value-adds are client software that you as a broker provide to make your client’s jobs easier, such as online portals, enrollment systems, HR applications and learning management systems.

Just like the quick wins, these solutions don’t have to be added all at the same time. You can decide which solutions are most essential based on your brokerage’s focus and clientele, and which you have the resources to implement.

It is also important to remember that by introducing client value-adds one at a time prevents you from overwhelming your customers. Imagine adding five new products all at the same time – that will quickly overwhelm your clients. It can also cause portal fatigue and actually result in lower usage and thus decreasing your ROI. Proceed at a rate that can be reasonably absorbed by your clients.

Want to Learn More?

If you’re willing to take the time and energy to invest in quality insurtech solutions, imagine all the efficiency and growth that your brokerage will be able to achieve. Your opportunities would be endless.

To learn about the process of implementing an effective insurtech sequence into your brokerage, you can download your free copy of the Sales Revolution by visiting www.insurancesalesrevolution.com.

About the Authors

Don Bailey has over 30 years of experience in the insurance industry, working in various roles spanning from underwriter to producer to CEO. He was the former Chairman and CEO of Willis Towers Watson North America, President of Allstate’s business-to-business portfolio of companies and the President of Global Sales at Marsh. Currently, he is a partner at Bristlecone Partners. In early 2019, Bailey joined Zywave as a member of its Advisory Board.

Jason Liu has over 20 years of experience leading multiple, high-growth software companies across the world. Previously, he served as CEO of UC4 Software, Univa UD and SAVO, a leading provider of sales enablement software. During his tenure at SAVO, he was at the epicenter of working with numerous large and midsized companies making the Sales Revolution transformation outlined in this book. In 2018, he became the CEO for leading insurtech provider Zywave.